The following talking points are drawn from the analysis and previous research on the Draft Law Governing the Resolution of Banks in Lebanon, and the Draft Law Aiming to Rebalance the Financial System in Lebanon entail a rescue plan – broadly achieved through bank resolution and deposit recovery – for Lebanon’s broken financial sector.

The following talking points are recommended:

- TALKING POINT 1: Protection and compensation of deposits

- TALKING POINT 2: Accountability of deposits

- TALKING POINT 3: Clawbacks and asset recovery

- TALKING POINT 4: Bankruptcy law 2/67

- TALKING POINT 5: Conflicts of Interest

TALKING POINT 1: Protection and compensation of deposits

Key Message:

Lirafication, the conversion of dollar deposits in banks into Lebanese pounds, is a core tenet of both draft laws at hand. There must be an outright and clear rejection of forced conversations of any and all involuntary conversions of foreign currency deposits.

- The Higher Banking Commission will be given the authority to convert both ”eligible” and “ineligible” deposits in foreign currencies.

- Not only will eligible deposits exceeding 100,000 USD be converted into Lebanese Lira (L.L) at the Sayrafa rate, significantly lower than the free market rate, but according to Caretaker Prime Minister Najib Mikati half of deposits under the 100,000 USD protection ceiling will be compensated in L.L as well.

- The level at which deposits are protected, or the equivalent of $100,000, is too low to fall in line with international standards and the ongoing bailout of the banks by depositors.

- The protection ceiling must be raised to 250,000 USD corresponding to standard deposit insurance per depositor set by the Federal Deposits Insurance Corporation in the United States.

TALKING POINT 2: Accountability of deposits

Key Message:

Funds based on ill-gotten gains must not be bailed out by the Deposit Recovery Fund (DRF).

- The draft law measures deposit inclusion in the DRF according to an eligibility criterion. It does not, however, include a highly necessary focus on investigating the legality of sources of wealth in influencing the allocation of “eligible” or “ineligible” deposits.

- The draft laws should, therefore, require that the depositors themselves (specifically, those with deposits above the protection ceiling) apply to be included in the DRF. This application should be submitted to an independent body of legal specialists who can consider evidence (documentary paperwork) provided by depositors to prove the sources of these funds were obtained through legal means, and all taxes have been duly paid up.

TALKING POINT 3: Clawbacks and asset recovery

Key Message:

Neither draft law explicitly states in detail the procedures for implementation of clawbacks, whereby funds obtained by bank management are subject to return.

- The Draft law details that clawback should only focus on siphoned funds, however, it should also focus on personal wealth of fraudulent management once charged.

- Clawback provisions should extend to all assets of the executives in question and include, at a minimum, funds which were siphoned outside the country before the capital controls were introduced and deposits of the executives in the bank itself

- Legislatively enshrining a mandatory requirement that all Lebanese banking institutions and the BDL include internationally established clawback provisions in their management and oversight structure would ensure that bank leaders avoided reckless or illegal behaviour or otherwise face severe financial penalties.

TALKING POINT 4: Bankruptcy Law 2/67 must be applied

Key Message:

Dubiously, both draft laws do not mention the need for banks to declare official bankruptcy before liquidation takes place. This obvious omission is most likely rooted in the fact that the bankruptcy law, or Law 2/67, already outlines a process of resolution for bankrupt banks.

- Under this law, managers of the banks become personally liable to the extent of their personal assets, which would include foreign assets.

- As such, the position of MPs should be that: (1) the laws in question do not supersede the Law 2/67, (2) that the process of Law 2/67 becomes integral to the resolution process, and (3) clawback provisions encompass asset recover operations and international cooperation to liquidate and return funds to Lebanon’s banking sector.

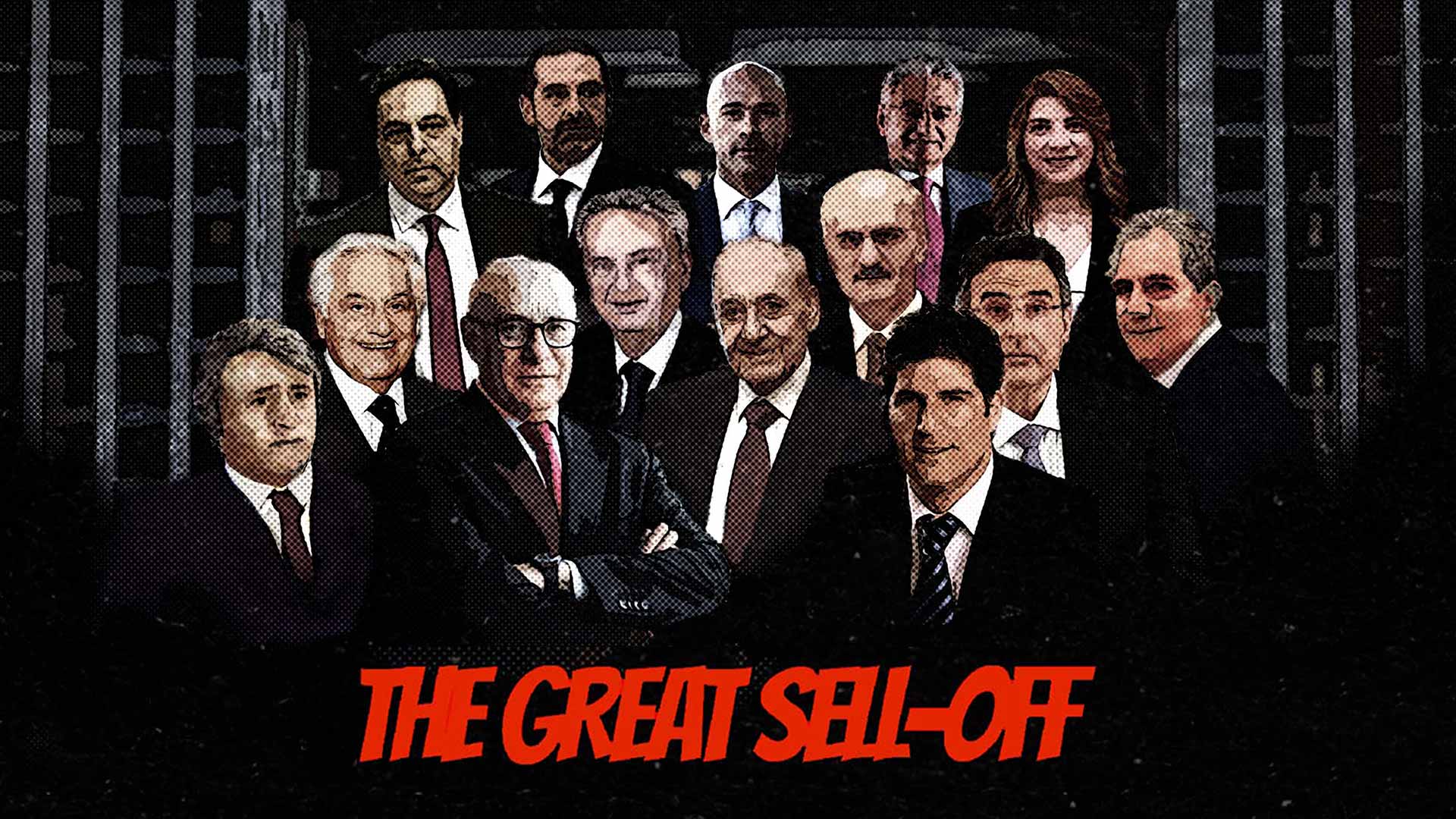

TALKING POINT 5: Conflicts of Interest

Key Message:

The governance makeup of the various entities tasked with the implementation of the draft laws have glaring conflicts of interest. These bodies, specifically the HBC and CoM will have unparalleled authority to shape the process of bank restructuring and deposit compensation.

- The HBC will have the authority to implement the bank restructuring and liquidation program, in contradiction to the already existent Bankruptcy Law 2/67.

- All other entities and individuals referenced in the law – the Liquidation Committee/Liquidators, Banking Control Commission, the Special Administrator, and Independent Valuers – are appointed by and answerable to the HBC. The HBC’s decisions are “irrevocable and not subject to appeal” or judicial recourse.

- The HBC is compromised by undue political influence, conflicts of interest among Commission members, and gaps that allow its Chairman (also Governor of the BDL) to dominate decision-making.

- The Council of Ministers is allocated the legal authority to establish and determine the makeup of the governing body of the DRF. There must be a rigorous list of criteria to be met in order to be in such a body including extensive specialist knowledge, no connections to any Lebanese political parties or interests, and no ties to any of the banks, their management, or employees, currently under investigation.