Founded: 1958

Total Assets*: US$26.48 billion

Customer Deposits**: US$21.06 billion

Ranking by Assets*: 2

(*as of Dec 31, 2021, ABL Almanac 2022 converted at 1507.5 LBP/USD)

(**as of Dec 31, 2020, Bilanbanques 2021)

Background

Banque du Liban et d’Outre-Mer (BLOM) was incorporated in 1958, with the founders aiming to develop business links between Lebanon and the diaspora community in Brazil. Among the founders were Hussein al-Oweini, who served as both finance minister and prime minister between 1948 and 1965,[1] Boutros Khory, the former head of Lebanon’s Economic Councils, and Philp Takla, who would go on to serve as Lebanon’s central bank governor.[2] The bank’s starting capital was drawn from its founder and directors, as well as various foreign governments, inclusive of Saudi Arabia, France, and Brazil.[3] Al-Ouweini, BLOM’s first chairman, was also close with the Al Saud ruling family in Riyadh.[4]

Naaman Azhari was appointed as BLOM’s general manager in 1962, after a stint at the Ministry of Finance, Economy and Planning in Damascus.[5] His son, Saad Naaman Azahri is BLOM’s current chairman.

Board and shareholder composition

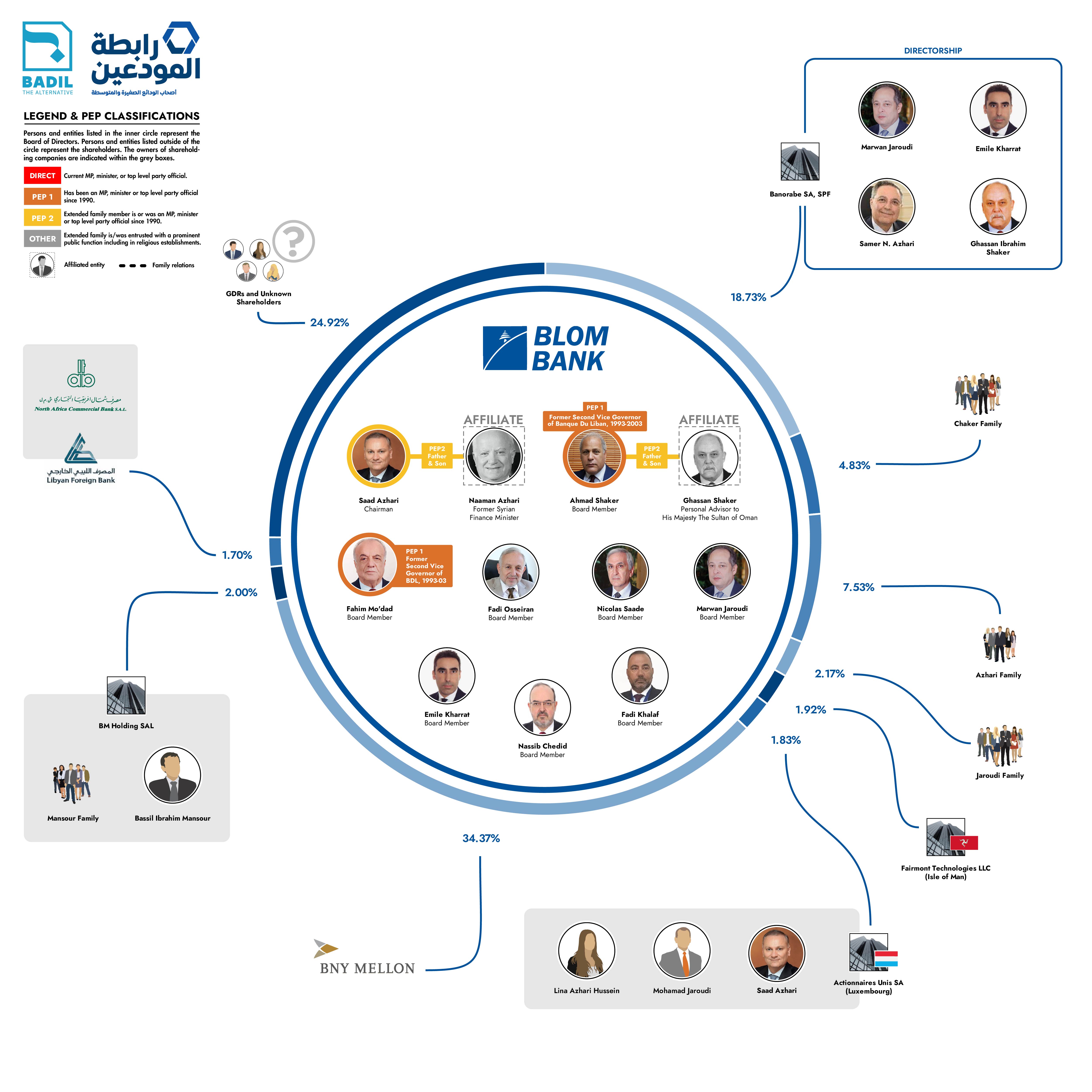

Bank of New York is BLOM’s largest shareholder, through global depositary receipts, with 34.37% of shares.

Member of the Azhari family directly own 7.53% of BLOM. The family also has seats on the boards of two Luxembourg-incorporated companies, Banorabe SA and Actionnaires Unis SA,[6] which hold 18.73% and 1.83% of BLOM, respectively. Other BLOM shareholders with seats on the boards of these two Luxembourg-based holding companies are the Jaroudi and Shaker families, with 2.17% and 4.83% direct stakes in BLOM.

All BLOM shareholders – with the exception of Bank of New York – also own shares in Banorable SA, however The Alternative was unable to confirm the distribution of shares in this holding company.

The Shaker family have a seat on the board filled by Ahmed Ghassan Shaker. Ibrahim Shaker was an early shareholder and long-time business partner of al-Oweini.[7] His son, Ghassan Shaker, who sits on the boards of Banoarabe and Actionnaires Unis, is a PEP by virtue of having served the Sultan of Oman as a personal advisor, as Oman’s Ambassador to the United Nations, and as that country’s Minister of Plenipotentiary.[8] Ghassan Shaker’s son, Ahmed, is a BLOM board member.

BLOM board member Fahim Mo’dad was formerly a second vice governor at Banque du Liban (1993-2003).[9]

[1] ‘Former Ministers’, 18 December 2019, https://web.archive.org/web/20191218051220/http://www.finance.gov.lb/en-us/About/Minister/Pages/Former-Ministers.aspx.

[2] Hicham Safieddine, Banking on the State: The Financial Foundations of Lebanon (Stanford University Press, 2019), pages 76, 200.

[3] Ibid.

[4] Ibid.

[5] Man Hon?, ‘نعمان أزهري’, accessed 10 March 2023, http://manhom.com\/شخصيات/%D9%86%D8%B9%D9%85%D8%A7%D9%86-%D8%A3%D8%B2%D9%87%D8%B1%D9%8A.

[6] ‘Luxembourg Business Registers’, accessed 20 March 2023, https://www.lbr.lu/mjrcs-lbr/jsp/IndexActionNotSecured.action?time=1679314029737&loop=3.

[7] Safieddine, Banking on the State.

[8] ‘Ghassan Ibrahim Shaker – Businessman, Banker, Industrialist and Diplomat’, accessed 7 March 2023, http://www.ghassanshaker.com/. Plenipotentiary is a a person and especially a diplomatic agent invested with full power to transact business, according to the Merriam-Webster dictionary.

[9] Banque du Liban, ‘GOVERNORATE TIMELINE’, accessed 7 March 2023, https://www.bdl.gov.lb/tabs/index/1/255/Governorate-Timeline.html.

Disclaimer

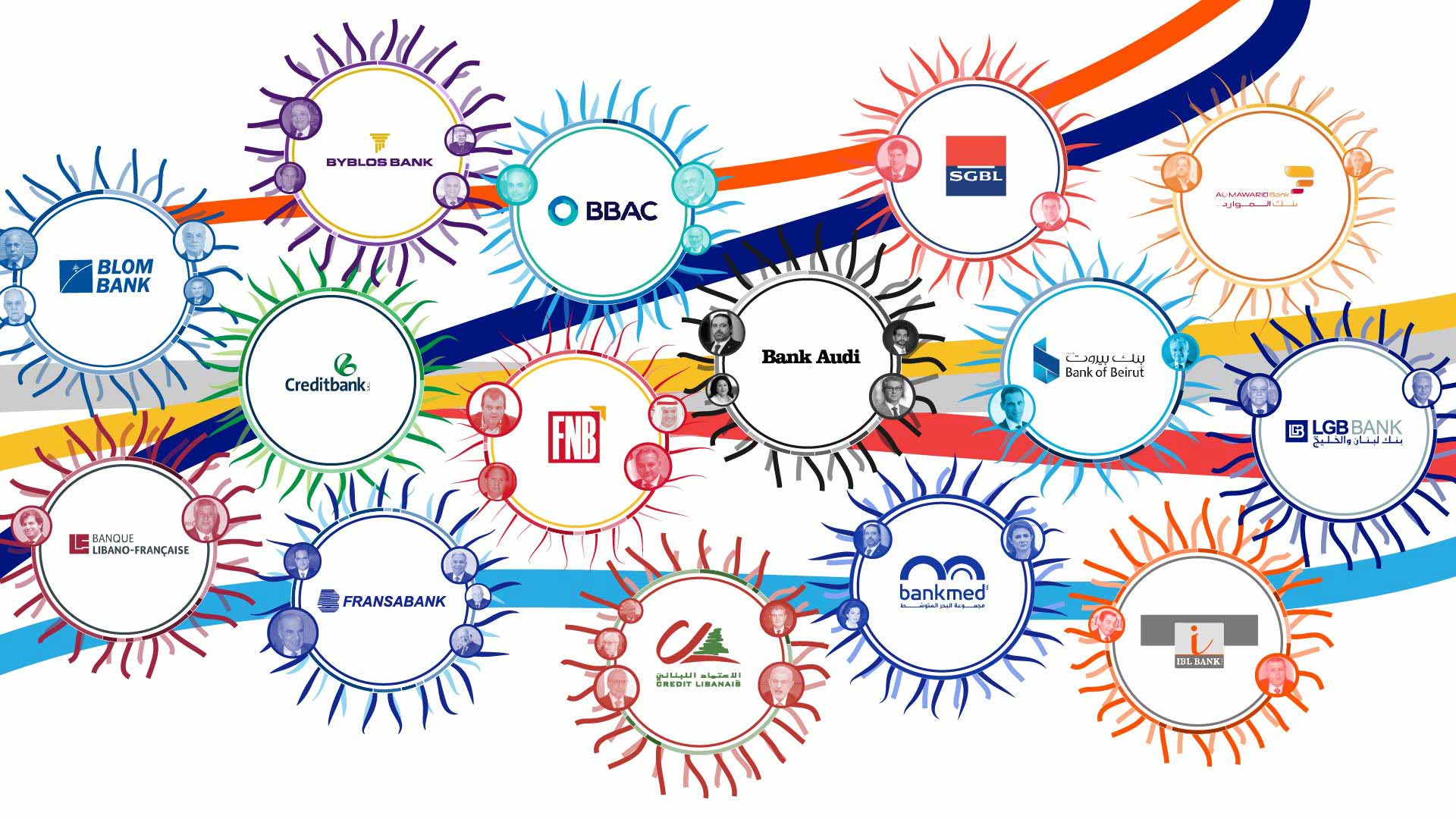

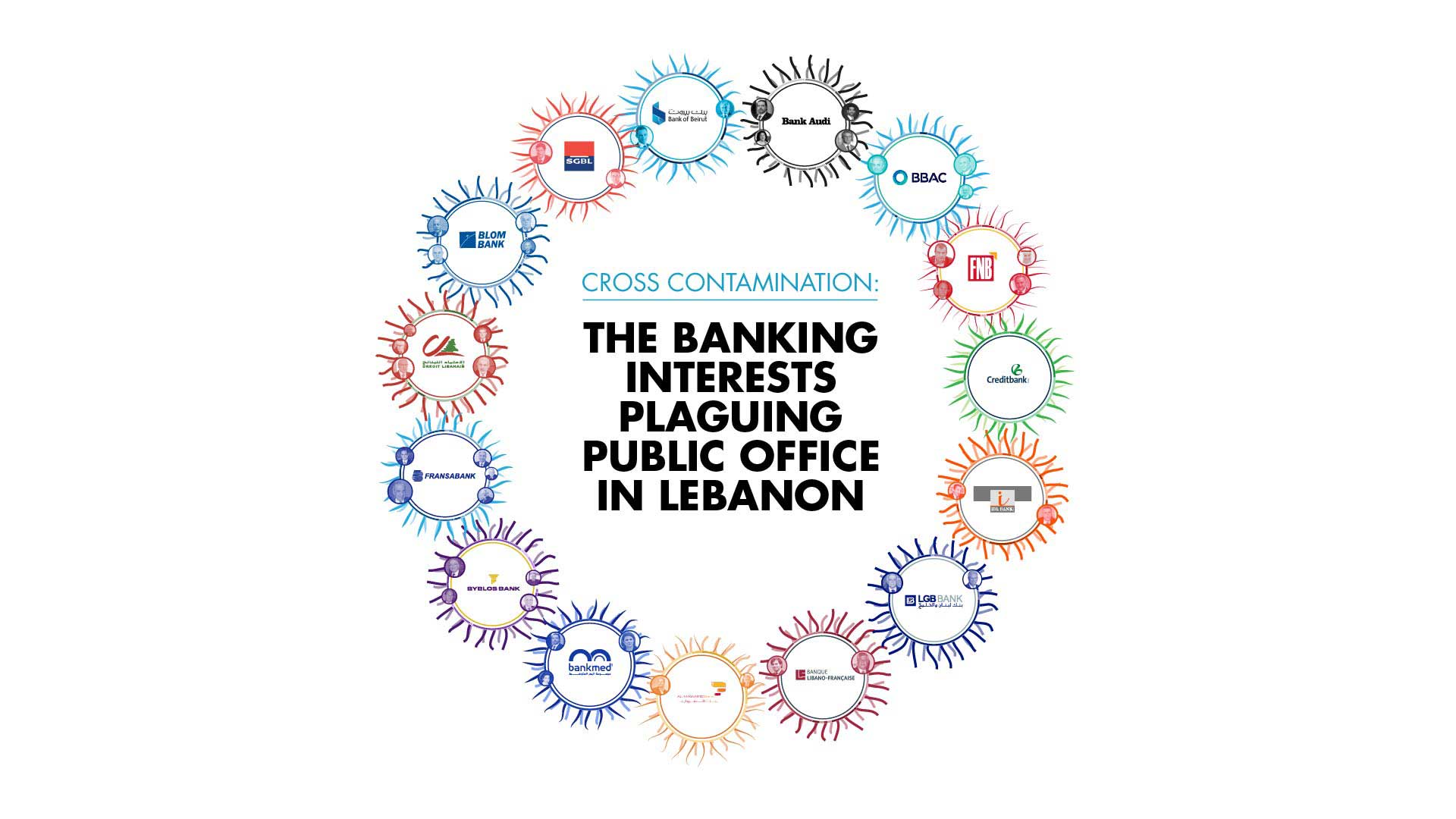

All content provided in this report (the Report) is for informational purposes only and does not constitute legal, financial or any other professional advice. The Alternative has made every attempt to ensure the accuracy and reliability of the information provided in the Report. However, due to the opacity of available sources of information, The Alternative has relied on the most up to date and self-reported figures from the Association of Banks in Lebanon (ABL) and its member banks, when available. When ABL and banks data was not available, The Alternative relied on physical copies of Lebanon’s commercial registry, online databases and other credible sources. In addition, The Alternative contacted each of the bank’s communications departments for confirmation of data regarding the shareholding and management of said banks. Only Bank Audi and BLOM Bank provided relevant information, both of which have been included in their entirety. Amongst others, the sources of the Report include various commercial registries, official bank websites, online aggregators, databases dedicated to company registration, the Organised Crime and Corruption Reporting Project (OCCRP), Bilanbanques reports, and many others.

The information provided in the Report is done “as is” without warranty of any kind, express or implied. The Alternative shall not be held liable for any errors or omissions in this information nor for the availability of this information. The Alternative does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained in the Report. Furthermore, The Alternative shall not be liable for any losses or damages from the display or use of this information. If anyone has information relating to the Report, The Alternative welcomes it. All information sent to The Alternative will undergo a thorough validation process, and the report will be updated accordingly. For any relevant information or inquiries, please contact [email protected].