Founded: 1950

Total Assets*: US$17.24 billion

Customer Deposits*: US$13.2 billion

Ranking by Assets*: 4

(*as of Dec 31, 2021, ABL Almanac 2022, converted at LL1507.5/US$)

History

Businessman Semaan Bassil Sr. and his brother Youssef Melkan Bassil established Société Commerciale et Agricole Byblos Bassil Frères & Co. in 1950, renaming it Byblos Bank in 1963 after their city of origin.[1]

Semaan Sr.’s son, Francois Bassil, is today chairman of the over-arching Byblos Bank Group, whose own son, Semaan Bassil, is chairman-general manager of Byblos Bank S.A.L.

Francois Bassil was elected chairman of the Association of Lebanese Banks (ABL) four times between 1994 and 2013,[2] and is a Trustee Board of the Maronite Foundation and was awarded the organization’s Cross of Maronite Merit.[3]

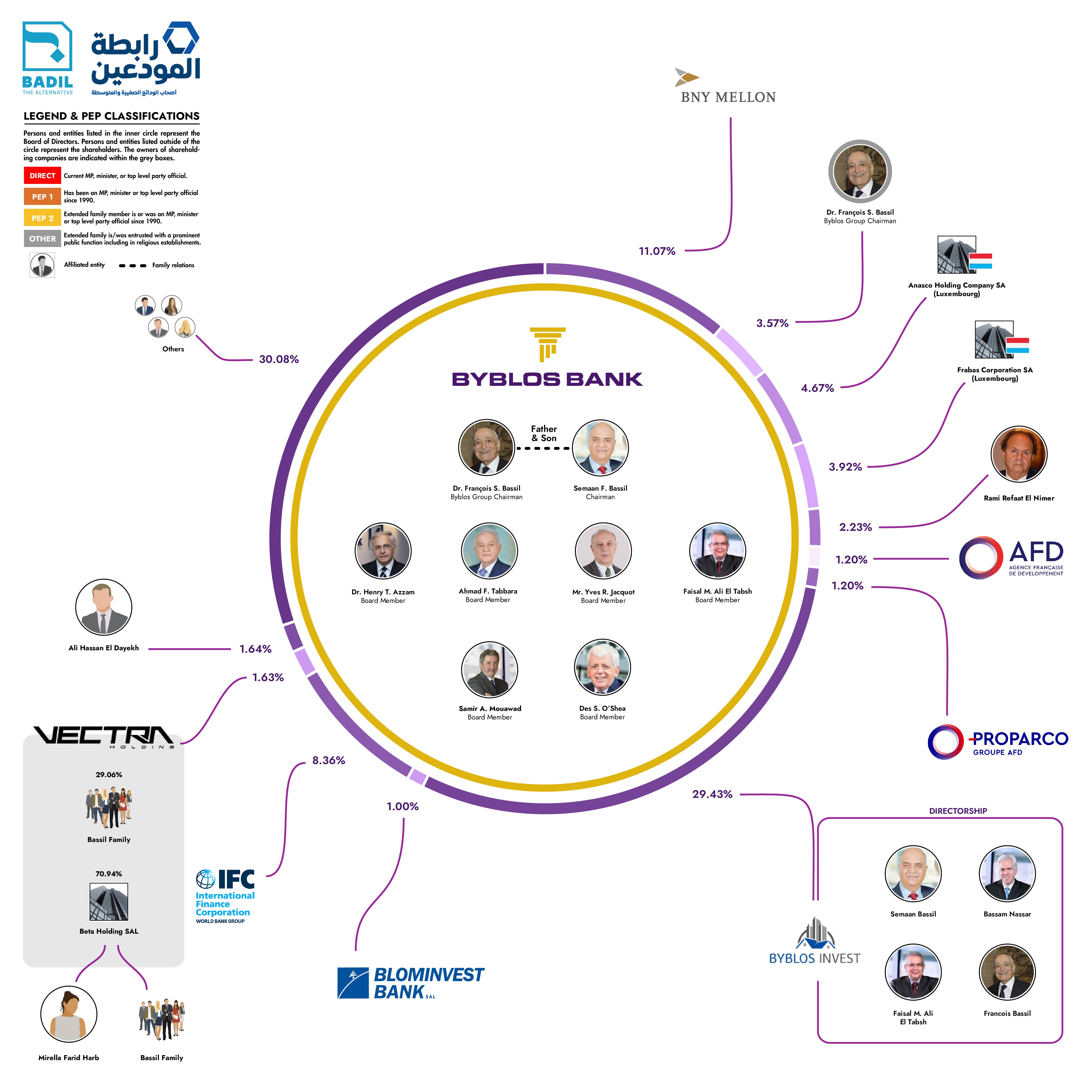

Shareholders

Byblos Bank Group is the overarching entity under which there is Byblos Bank SAL, the commercial banking arm, and Byblos Invest Holding SA, a Luxembourg-based holding company which is the largest shareholder of the commercial banking operation, with 29.43% of Byblos Bank’s shares.[4] Byblos Bank and Byblos Invest Holding SA share various board members, including Faysal Tabsh, Bassim Nassar, Francois Bassil, and Semaan Bassil.

The second largest Byblos Bank shareholder is Bank of New York (BNY) Mellon with 11.07%.[5] The two banks have enjoyed close ties, with BNY Mellon serving as a depository bank for Byblos Bank’s global depository receipt (GDR) programme since 2009.[6]

Notably, as of the bank’s 2018 Annual Report, Byblos Bank had “tapped into several types of long-term funding resources” from international entities. This included US$161 million from the European Investment Bank, US$25 million from Govco Incorporated NY, US$15 million from Agence Francaise de Développement (AFD), and $390,000 from the International Finance Corporation (IFC).[7]

As of end-2021, and IFC and AFD were listed as Byblos Bank shareholders, with 8.56% and 1.2% stakes, respectively.

Francois Bassil owns a further 3.57% of Byblos Bank under his own name.[8]

[1] ‘Banks in Lebanon’, Ostamyy, accessed 01 March 2023, https://web.archive.org/web/20140328064540/http://www.ostamyy.com/banks/Lebanon.htm

[2] ’Board of Directors’, ABL, accessed 02 March 2023, https://www.abl.org.lb/english/about-abl/presidents-of-board-of-directors

[3] ‘Antoine Klimos decore Francois Bassil’, L’Orient le Jour (Online: 16 April 2017), online at: ; ‘Antoine Klimos: A Man of Principles’, Prestige Magazine (2019), online at: https://www.prestigemag.co/2019/10/antoine-klimos-a-man-of-principles/.

[4] Association des Banques du Liban, ‘Almanac of Banks in Lebanon 2022’.

[5] Association des Banques du Liban, ‘Almanac of Banks in Lebanon 2022’.

[6] Global Custodian, (Online: February 2009), online at: https://www.globalcustodian.com/bny-mellon-will-serve-depositary-bank-for-byblos-bank39s-gdr-program/

[7] Byblos Bank, ”Annual Report 2018”, (Online, 2018), accessed 8 MAach 2023, p. 73. Online at: https://byblos.byblosbank.com/files/Library/Assets/Gallery/FinancialResult/AnnualReports/Downloadthefull2018AnnualReport/Annual%20Report%202018.pdf ; The IFC previously announced a $100 million investment in Byblos Bank in 2010. ’Pressroom’, IFC, (Online: 27 January 2010), online at: https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=23235

[8] Association des Banques du Liban, ‘Almanac of Banks in Lebanon 2022’.

Disclaimer

All content provided in this report (the Report) is for informational purposes only and does not constitute legal, financial or any other professional advice. The Alternative has made every attempt to ensure the accuracy and reliability of the information provided in the Report. However, due to the opacity of available sources of information, The Alternative has relied on the most up to date and self-reported figures from the Association of Banks in Lebanon (ABL) and its member banks, when available. When ABL and banks data was not available, The Alternative relied on physical copies of Lebanon’s commercial registry, online databases and other credible sources. In addition, The Alternative contacted each of the bank’s communications departments for confirmation of data regarding the shareholding and management of said banks. Only Bank Audi and BLOM Bank provided relevant information, both of which have been included in their entirety. Amongst others, the sources of the Report include various commercial registries, official bank websites, online aggregators, databases dedicated to company registration, the Organised Crime and Corruption Reporting Project (OCCRP), Bilanbanques reports, and many others.

The information provided in the Report is done “as is” without warranty of any kind, express or implied. The Alternative shall not be held liable for any errors or omissions in this information nor for the availability of this information. The Alternative does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained in the Report. Furthermore, The Alternative shall not be liable for any losses or damages from the display or use of this information. If anyone has information relating to the Report, The Alternative welcomes it. All information sent to The Alternative will undergo a thorough validation process, and the report will be updated accordingly. For any relevant information or inquiries, please contact info@thebadil.com.